This post originally appeared on Capchase's blog.

How to protect your SaaS business during market uncertainty

Public tech stocks have been on a downward trend the last few months in the US & Europe. Looking at SaaS specifically, Byron Deeter, partner at Bessemer Venture Partners, said the median company in their index of subscription software stocks is down 53%, and price-to-revenue multiples have dropped, on average, from 25 to below 12.

This bear market is driven by rising inflation and interest rates, as well as Russia’s invasion of Ukraine.

Private market correction has already started

In 2021, we saw large VC rounds at eye-watering valuations. However, private and public markets are intertwined, albeit the private valuations take time to correct. We’re now seeing the private funding market slowing down, a trend that started just at the start of this year.

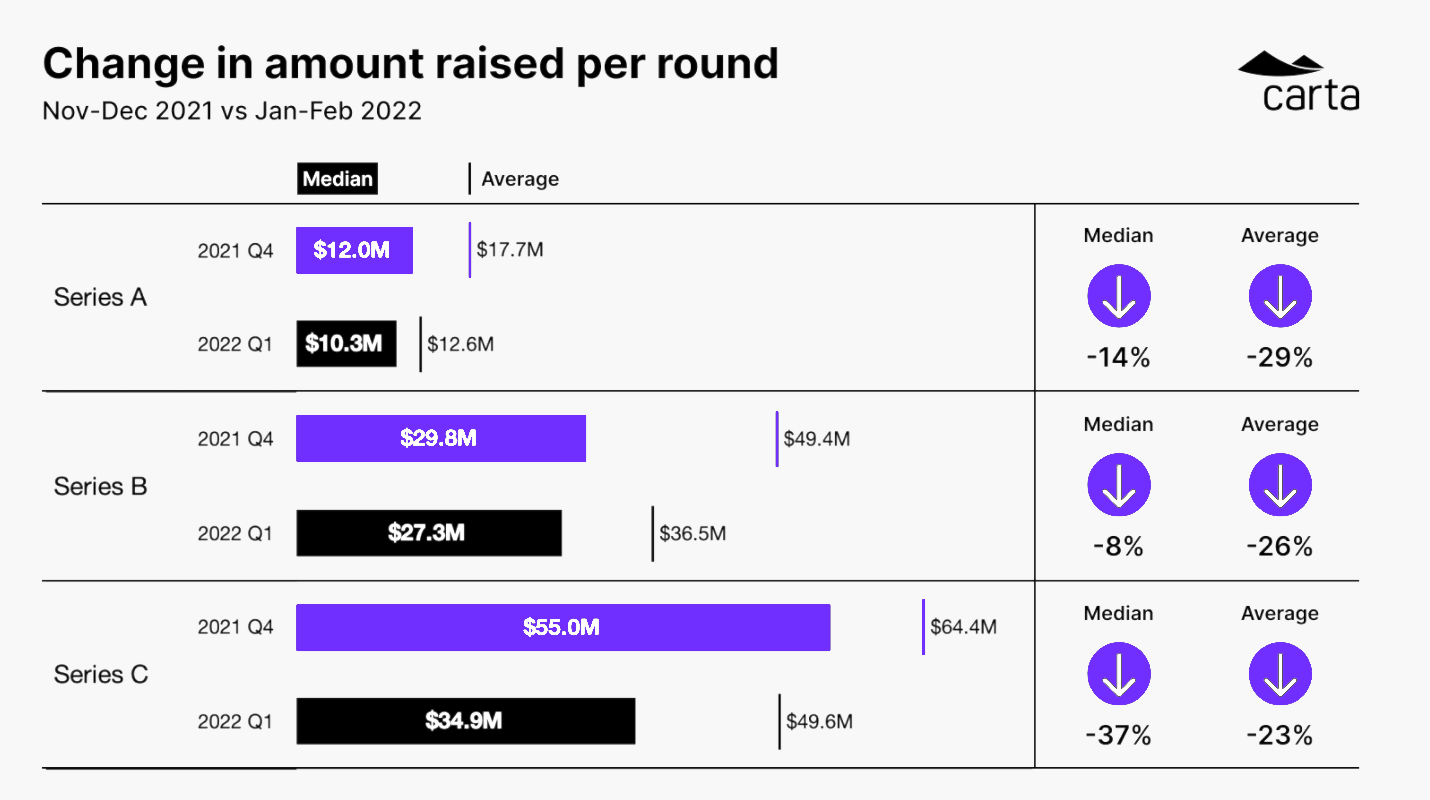

Based on recent data from Carta, Series A to Series C round sizes in the US are lower - along with valuations of those deals.

What does it mean for SaaS founders?

CEOs and CFOs we speak to are increasingly nervous about future funding options for their businesses.

Below, I look at how current market conditions could impact SaaS in the next 12-18 months. I’ll touch on key inputs for your business (access to capital and talent), as well as one of your key assets (current customers), how they may be affected by market turmoil, and what measures you can take to mitigate risks.

Access to capital will be affected

Usually a company’s access to capital comes from three sources: cash you already have, new capital from existing financing partners, and new capital from new financing partners.

Our Co-founder & COO, Przemek Gotfryd, has already written on how to plan your capital availability under different scenarios. I’ll therefore focus on raising new capital.

For anyone that already has equity investors or other financing partners on your cap table, now is the time to stay in contact and plan the future together, to make sure you’re aligned on the market situation, and its implications on your business.

However, the decrease in valuations at exit will put pressure on your investors to drive more value creation per dollar invested in order to reach the same expected returns.

There are three ways for an investor to make this happen:

- Make the company go further with the capital they’ve already invested (avoiding further capital injections)

- Find additional capital without impacting the company’s valuation (eg debt or non-dilutive financing)

- Invest more, but at a lower valuation

What to look out for

With that in mind, here are four things to look out for from investors during market turmoil:

1. Pressure to cut costs

We’re already seeing many high profile tech companies taking decisive action, with the likes of Hopin, Peloton, and others reducing headcount to prolong cash runway.

What to do: Do scenario planning early and often to stay in control. Our Co-founder & COO recommends founders should switch from occasional financial planning to monthly re-calibration.

2. Declining investor risk appetites

Expect slower fundraising processes, as more analysis and discussion will go into investor decisions in 2022. Decisions may be more cautious, and we’re seeing lower roundsizes and valuations as well as less founder-friendly terms.

What to do: Plan fundraising months in advance, and lower your expectations of what you'll get from new and existing investors (amount to invest, valuation, key terms, etc.).

3. Investigate alternative financing options

Research non-dilutive capital and alternative lenders as they may be able to provide working capital to help you fund or extend your cash runway to delay your next equity round. We’re seeing increased interest in our non-dilutive funding option.

What to do: Make sure you’re aware of and understand the range of financing options available to you that are suitable for your business needs, stage, and risk profile. Engage early with different providers to understand their offers and plan ahead.

4. Predatory behavior

Not all investors take a founder-friendly perspective during turbulent times. Beware of investors offering aggressive terms or changes to your shareholder agreement. Look for things like changing liquidation preferences or voting rights, or valuation step-downs. A down round (equity injection with valuation decrease) may be a valid last resort, but it risks negatively impacting motivation for founders, employees, and early investors.

What to do: Ensure you have trusted advisors, to help spot predatory behavior.

Work to maintain your key asset: your customers

The key asset for a SaaS company is recurring revenue. Making sure you retain existing customers during uncertain times is vital. Your customers are likely facing similar market challenges and this could impact you via:

1. Pressure on payment terms and pricing

Most companies go into cash preservation mode during turbulent times. Anticipate requests from customers for flexibility on payment terms and pricing.

What to do: Prepare your customer service team for tough discussions with customers, and ensure you have a playbook in place for what to say, ideally tiered by size and strategic importance of your customers.

2. Increased churn

Depending on your business model, you can expect some customers to seek to churn (so they preserve cash).

What to do: Understand your churn risk, and prepare mitigation strategies if you see increases. Consider proactive outreach, discounts, or payment holidays.

Hiring decisions will be very important

Your team will be affected by market turmoil, so it’s vital to continue to retain and attract top talent.

Existing talent - A key driver of performance is motivation of employees. Spend time and energy on keeping your teams aligned, focused, and inspired. There are three ways your team could be affected:

1. Questions about the business plan

State clearly where you’re heading and how you’re dealing with market conditions. Remind employees of your big vision and how you’ll get there.

2. Negative rumors/gossip

Market turmoil can trigger negative rumors concerning customer viability, funding, people practices, and these rumors can often erode culture and team spirit. Be a role model, address the rumors transparently, and answer people’s questions regularly, honestly and clearly.

3. Concern over compensation

If you’re using options or other equity instruments to compensate employees, expect questions around how market dynamics are impacting employees’ remuneration. Remind employees that market corrections are typically short-term. Consider having discussions with top-performers, allowing for top-up/alternative structures, if needed.

New talent - Hiring is, and will continue to be, one of the most important processes. Hiring against an uncertain economic backdrop is more difficult, but can have upsides.

Motivated applicants - During turbulent times, people prioritize job safety and certainty, while in bull years they favor financial upside. Expect candidate numbers to shrink during market uncertainty. However, the quality of candidates will likely increase, as true believers still apply. If your company is alive and well funded, and able to hire talent that’s still hungry for adventure, you may come out stronger. However - expect it to take longer to find your next hire.

Prepare for the bounceback (quietly)

It’s important to remember the market uncertainty will pass at some point. When the pandemic hit in Q1’2020, private venture funding only paused for one quarter before rebounding to hit record highs in 2H2020 and throughout 2021. Leading venture funds and alternative lenders have a lot of dry powder to finance companies that are growing and have strong unit economics.

Financial planning will help you navigate through the current market uncertainty, and asking experienced advisors for their suggestions can help.

At Capchase, we act as unbiased growth advisors to our clients, using our insights from analyzing thousands of B2B companies to provide options according to your financial needs.

About Capchase

Capchase is a platform for recurring-revenue companies to secure non-dilutive capital. Founded in Boston, MA in 2020 and headquartered in New York City, the company provides financing by bringing future expected cash flows to the present day – thereby extending an immediate line of credit. Companies that work with Capchase are able to secure funding that is fast, flexible, and doesn't dilute their ownership.

Gust Launch keeps your docs straight and cap table clean for whatever your first raise is.

This article is intended for informational purposes only, and doesn't constitute tax, accounting, or legal advice. Everyone's situation is different! For advice in light of your unique circumstances, consult a tax advisor, accountant, or lawyer.